At the start of Monday last week, it was clear the markets were riding high off the new wave of positivity that has captured investors. Some negetive numbers were even shaken off by this hugely positive outlook. The Risk Aversion trade was no where to be found. It seemed like there was some agreement among everyone that we were going to get out of this thing. I thought it might be the beginning of the end for the dollar, at least in the short term.

Not so. The Dollar fought back before the end of the week. I suppose there was good reason. While there is much hope that things are getting better (I should really say that the rate of getting worse is less), there are still issues. Some economists have urged caution. The recent rally in the Equity markets will not continue indefinitely. There will likely be another dip before we go back up. So it’s no surprise that bad news is still there.

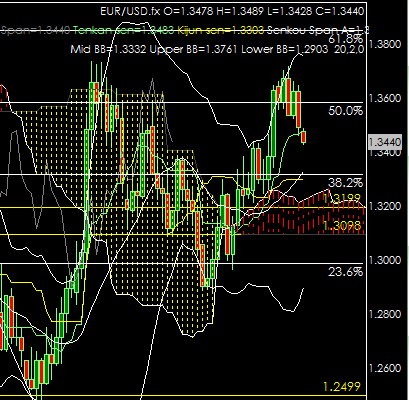

The GDP numbers out of Europe were pretty bad…I’m talking a Growth rate that is the worst on record. What a way to bring everyone back down to earth. That overshadowed some not so bad news…like the fact the consumer prices rose slightly. The result of this was a beating at the hands of the dollar. The Single Currency did gain on the Swiss Franc though. It’s an interesting offshoot of steps the Swiss National Bank has been taken to devalue it’s currency. There was a bit of an uproar about this some time ago, but it seems everyone has forgotten. The Pound is in a similar situation as the Euro. Both of these forex pairs (EURUSD and GBPUSD) seem to be the most susceptible to news this week. We will have to watch carefully for any more disappointing news.

The Commodity pairs all got drubbed as well. A combination of dodgy economic data and a stall in Commodity prices. The Yen was the most triumphant currency for the week, gaining on everyone, in spite of the bad news on their economy. The Risk Averse trade is still helping the Yen, but we’ll see how much longer this lasts. There is a load of news for the Yen this week as well. A reaction is guaranteed.

It’s back to watching the news events closely. No telling where things are going to go…