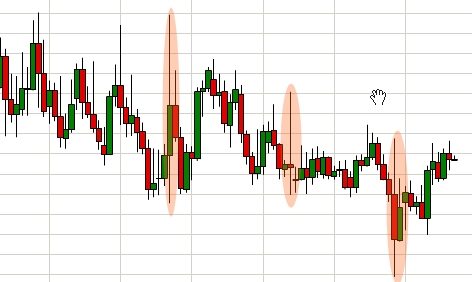

Check out the chart below. This is a chart of the Forex pair EUR/CHF (Euro against the Swiss Franc).

You can see that, in general, the pair has spent the best part of the last 4 months moving sideways. That’s not to say it has been a smooth ride though. I have highlighted a number of candlesticks on the chart. You can see the ridiculous levels of volatility on those days.

This pair has behaved terribly…from a daily chart perspective. If you had attempted to make a short term play on this pair on any of those days, incorporating any sensible level of risk management, chances are that you’d have been stopped out (then, just to make you feel worse, the price would probably have headed back and hit you target).

There’s just so much volatility, it’s almost pointless trying. You see this sort of behavior mostly with “exotic” currency pairs (think USD/TRY, USD/ZAR etc). Volume is so low that smaller amounts of people can cause violent moves like we see on this graph.

One of the main advantages touted about forex trading is liquidity…so much volume that no single person or group can overly influence the direction of a given pair (on purpose or not). There’s also a greater chance of stability, in general. All that goes out of the window for pairs like these.

There are other reasons why such instability could occur. In any case, the end result is the same: violent moves that can leave you bruised.

This underscores the negative side of setting stops. You have to pick your pairs carefully and ensure you give enough room so you don’t get stopped out of trades unnecessarily.

Sometimes, you just have to wait.