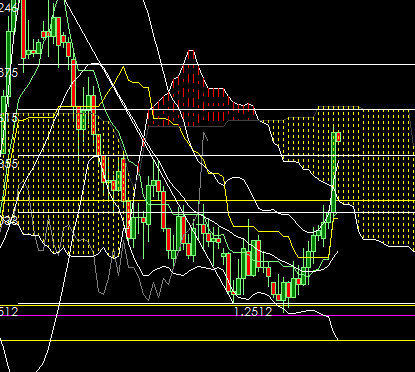

The EUR/USD chart below shows what happened to the dollar in the Forex Markets after the Fed announced that it was going to buy up US Treasuries…to the tune of 1 Trillion Dollars.

1 Trillion Dollars…That is some major dough. The US Dollar lost ground across the board, even to the Yen. That highlights an interesting point. In the past, we’ve seen the Yen lose value when confidence is up and Equities gain. In situations like these, the US Dollar would lose value against most other currencies, but gain on the Yen. Yesterday’s case was different. The Fed buying up all treasuries on this scale is bad for the dollars. When a commodity becomes available in large quantities, it loses value. The Fed is going to be printing shedloads of money, so the dollar will lose value.

On the other side of that equation, such an action is actually perceived to be GOOD for the US economy; and good for confidence. So, people tend to invest in high yielding currencies when they have confidence in the markets. The Euro, Aussie Dollar etc. all do well in these conditions. Add to the fact that confidence has been returning (based on that rally we just had), and you have a particularly violent Mortal Kombat finishing move. For non-Mortal Kombat initiates…this is a devastating effect that isn’t likely to reverse easily.

It’s funny how things can change. It was just a couple of days ago when most people still thought the dollar would retain its strength for some time to come, barring some major incident. Voila! Major Incident!!

This is what being decisive means. Bernanke gets points for doing this. This should unplug all the drains. Loans, Credit, everything. This is going all in. Hopefully it works, or else…

So, long term dollar trend anyone? My guess for now is…well, down.